Are you retired and considering taking money out of your 401(k) to supplement your pension or other forms of income? If so, you need to know whether 401(k) withdrawals are considered part of your taxable income. Understanding the tax implications can be difficult for those who haven’t dealt with this issue.

In this blog post, we'll discuss which withdrawals from a 401(k) account are taxed and what you need to do to remain compliant with IRS regulations.

Read on for more information about how to use a withdrawal from a 401(k) without any extra financial penalties come tax season!

What is a 401(k) and How Does It Work

A 401(k) is a retirement savings plan offered through employers whose primary purpose is to help employees save for retirement. Withdrawals from these accounts are typically made after an employee has left the job and reached age 59 ½.

Contributions to a 401(k) can be pre-tax or post-tax. Any pre-tax contributions are not included in your taxable income when you file, while post-tax contributions are considered taxable.

What Are the Rules for Withdrawal from a 401(k)?

When you retire, you can make money from your 401(k) account. According to IRS regulations, the amount you withdraw from your 401(k) is considered taxable income and must be reported on your tax returns for the corresponding year.

However, this does not mean that all withdrawals are subject to taxation—several exceptions exist. For example, if you withdraw money within the first 60 days after leaving your job or if the withdrawal is due to a qualifying financial hardship, you may not be subject to taxes on the amount withdrawn.

Additionally, withdrawals made after age 59 ½ generally won't incur any extra taxes beyond regular income tax (up to certain limits).

Are 401(k) Withdrawals Taxable and Considered Income on Your Taxes

When you are retired and living off a pension or other income streams, it may be necessary to supplement your income with 401(k) withdrawals. But before making any withdrawals from your 401(k), it’s important to understand the tax implications.

The first thing to know is that, in most cases, 401(k) withdrawals are considered taxable income. The amount of tax you will owe on your withdrawal depends on a few factors, including age, the type of account, and when you contributed to the account.

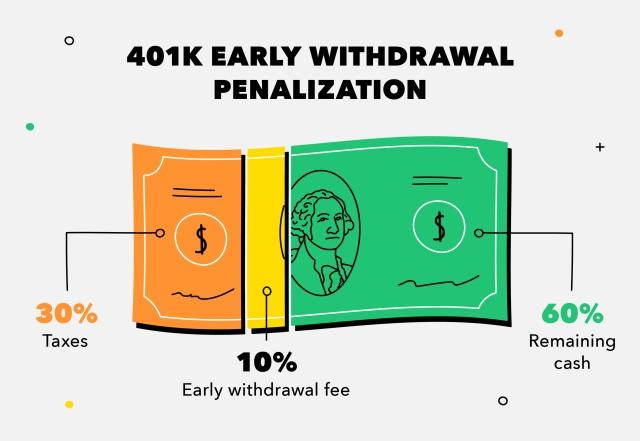

Generally speaking, if you make regular contributions to a traditional 401(k), any withdrawals from the account before age 59 ½ will be subject to a 10 percent early withdrawal penalty in addition to the regular income tax. However, if you are over 59 ½ and your account is an after-tax Roth 401(k), then distributions from the account may not be taxed at all.

To remain compliant with IRS regulations, you must stay up-to-date with the current rules and regulations regarding 401(k) withdrawals. This includes understanding your retirement plan’s withdrawal requirements and filing taxes accurately when withdrawing from a 401(k).

Additionally, you can consult with a financial advisor to ensure that any withdrawal decisions you make align with your overall financial goals.

What Happens if You Take Money Out of Your 401(k) Before Retirement Age

When it comes to withdrawals from a 401(k) account, there are certain rules and regulations you must abide by to remain compliant with IRS guidelines. Generally speaking, if you take money out of your 401(k) before the age of 59 1/2, you'll be subject to a 10% early withdrawal penalty. The amount you take out will also be included in your taxable income for that year.

The only way to avoid the 10% early withdrawal penalty is if an exception applies. For example, certain medical and higher education costs qualify as exceptions and may allow you to withdraw money from your 401(k) before retirement age without additional taxes or penalties.

It's important to remember that even if you qualify for an exception, the money you take out of your 401(k) will still be considered income and may be subject to other forms of taxation. If you find yourself in a position where you need to withdraw from your 401(k), it's best to speak with a tax specialist first to ensure you understand all of the potential consequences.

Though it may be tempting, taking money out of your 401(k) before retirement age should only be done as a last resort. Not only could it result in additional taxes and fees, but also you will have less money saved for retirement. Remember that if you wait until retirement, your 401(k) withdrawal will be tax-free.

Ultimately, it's important to understand the implications of taking money out of your 401(k) before retirement age and weigh them against your current financial situation.

How to Minimize Tax Penalties on Early Withdrawals from a 401(k)

Consider Taking Only Required Minimum Distributions (RMDs): According to the IRS, individuals must take RMDs annually when they turn 72. It is important to note that if you withdraw any more than what is required for your RMD, it will be subject to taxes and other penalties.

Consider Making Partial Withdrawals: Partial withdrawals (often called 'hardship withdrawals') are available to those who demonstrate a financial need and meet certain criteria. The withdrawal amount is subject to taxes, but it can also help you avoid larger tax implications associated with early withdrawal from your 401(k).

Set Up a Payment Plan: If you have to take money out of your 401(k) to cover expenses, setting up an annuity or payment plan with the company that administers your account may be beneficial. Doing so can help spread out the taxes you will owe and avoid large lump sums being taken from your account in one year.

Utilize Other Tax-Benefited Accounts: Before taking money out of your 401(k), consider any other tax-benefited accounts, such as IRAs and 529 plans, that could help reduce the amount you need to take from your retirement fund.

Consider a Roth IRA Conversion: Converting some or all of your 401(k) balance to a Roth IRA account can help reduce taxes. Although you must pay taxes on the converted amount, any future withdrawals are not taxed, and earnings are tax-free.

Make Sure You Have Ample Funds in Savings: Before making any withdrawals from your 401(k), ensure you have ample funds for emergencies and other unexpected expenses. This will ensure you don’t need to dip into your retirement savings more than necessary and minimize the taxes due on the withdrawal.

FAQs

What are the distribution options for my 401(k)?

Your 401(k) plan may provide several distribution options, from taking a withdrawal to doing an in-service or hardship withdrawal. Understanding each option’s distribution rules and tax implications is important before making decisions.

Are 401(k) withdrawals considered part of my taxable income?

Yes, most 401(k) distributions are taxable income by the IRS and must be reported on your annual tax return. Traditional pre-tax contributions (made when employed) and earnings on those investments are all included in your gross income and taxed accordingly.

How do I withdraw money from my 401(k)?

You can request a withdrawal from your 401(k) through your plan administrator. Generally, you'll need to provide basic information. Depending on the type of withdrawal that you are making, there may be other required documentation or special forms that must be completed.

Conclusion

the answer to the question "Are 401(k) Withdrawals Considered Income?" is both yes and no. When withdrawing, 401 (k) plans are subject to taxation if withdrawn before a certain age without penalty. On the other hand, withdrawals that meet specific criteria may be excluded from your income for the tax year and might also qualify for additional tax benefits.