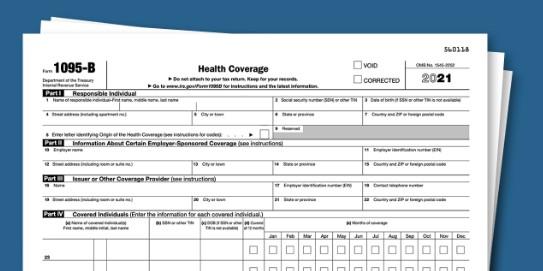

Are you wondering what Form 1095-B: Health Coverage is and why it’s necessary? The 1095-B is an important form for individuals who received health insurance coverage over the past calendar year.

It summarizes those benefits, including important details such as the policy coverage dates, type of plan, and any additional covered family members.

This information is critical if you need to file your taxes or have a question about your existing coverage.

A Brief Overview of Form 1095-B and What It Is Used For

Form 1095-B is an information form issued by employers or providers of self-funded health insurance plans which provide coverage for 12 months. It provides details about the type and length of your health coverage and includes additional information such as any covered family members or policyholder’s name.

This form is important because it lets the IRS know whether you and your family had health insurance coverage for the entire year. If you did, you are eligible for certain tax benefits, such as deductions and credits. Qualifying for these advantages could be easier and easier with this form.

Understanding Form 1095-B may be confusing and overwhelming. That’s why we want to make it easier for you by providing the necessary information in this post so that you understand your obligations and can successfully fulfill them.

What Types of Health Coverage Qualify for Reporting on Form 1095-B

Form 1095-B is used to report certain types of health coverage. This includes

- Coverage through a government-sponsored program, such as Medicare or Medicaid

- Coverage provided by an employer (also known as group health coverage)

- Individual market plans are purchased either on or off the Marketplace.

- Certain types of other coverage, such as health care sharing ministry.

It’s important to note that Form 1095-B doesn't include any information about your medical expenses or the cost of your coverage. It details the type and duration of coverage you received during the year.

Who is Required to File a Form 1095-B: Health Coverage

Form 1095-B: Health Coverage is required by the Internal Revenue Service (IRS) for individuals who received health insurance coverage the previous year.

This includes employer-sponsored plans and individual plans purchased through state or federal exchanges. All insurers that offer such plans are legally obligated to provide customers with a Form 1095-B.

It’s important to note that not everyone is required to file this form. Those who qualify must:

- Have health insurance coverage for any part of the year, even if it is only one day

- Have health insurance through an employer or purchased through a state or federal exchange

- Have a policy that provides minimum essential coverage.

In addition, those receiving health insurance through the Medicare or Medicaid programs are not required to submit Form 1095-B. The same applies to employers with at most 50 full-time employees without providing such coverage under the Affordable Care Act (ACA).

How to Obtain Your Form 1095-B

The first step to obtaining your Form 1095-B is to contact your health insurance provider and ask for a copy of the Form 1095-B. Most providers must send this document out by March 2nd, although some may provide it sooner. Ask for an electronic or physical copy - many companies now offer digital delivery options to expedite the process.

Contact your provider for an additional copy if you still need to receive your 1095-B form. The contact information is typically printed on the back of the insurance card or available through their website. You may also request assistance from a local IRS office or tax professional.

Generally speaking, the IRS suggests that if you are still waiting to receive the form by early March, contact your health insurance provider as soon as possible.

Once you have obtained a copy of your 1095-B Form, it is important to review all of the information carefully. Ensure that the details on the form match what you know to be true and that any listed family members are accurate. If you notice any incorrect information, contact your health insurance provider immediately to rectify the issue.

Following these steps will help ensure a smoother tax filing process and provide peace of mind knowing that your health coverage information is correct.

Common Mistakes Made When Filing Form 1095-B

Common mistakes made when filing Form 1095-B include:

- Check only some forms for accuracy: Before submitting your form, ensure all its information is accurate and up-to-date. This includes names, Social Security numbers, coverage dates, and other important information.

- Not providing complete information: Your Form 1095-B should include all the people covered under your health plan for the year you received coverage. The IRS won't accept the form if family members’ information is missing.

- Failing to include all insurance companies: Ensure you include information from all insurers in your Form 1095-B. This includes any company providing Medicare, Medicaid, and private health insurance coverage plans.

- Need to identify the correct plan type: The form requires you to list the health coverage you received during the year. Ensure you correctly identify the plan types, including whether it was an employer-sponsored plan or a non-employer-sponsored one.

- Not filing on time: The IRS has set deadlines for when Form 1095-B needs to be filed to avoid penalties. Failing to meet these deadlines could result in fines or other penalties.

By avoiding these common mistakes when filing your Form 1095-B, you can ensure that the information is accurate and up-to-date.

Steps to Take if You Receive an Incorrect or Incomplete Form 1095-B

The 1095-B form is important for taxes and insurance purposes, so the information must be correct. If you receive a form with incorrect or incomplete information, contact your health insurance provider immediately to determine how to fix the issue. This could include providing additional documentation or records of coverage that may have needed to be included on the form.

Your provider should be able to provide you with an updated form or additional documentation that confirms your coverage and policy details. When filing your taxes, you must submit this information to ensure you are up-to-date on all your obligations.

If you're still unsure how to proceed, consider consulting a tax professional to help understand your situation and filing requirements.

FAQs

What happens if I still need to receive Form 1095-B?

If you did not receive Form 1095-B, that is ok. You are still required to report your health insurance coverage when filing taxes, but you can use other records, such as paystubs or W2 forms, to help meet the requirements.

Where can I get more information about Form 1095-B?

You can contact your health insurance provider for more information on Form 1095-B. They can provide additional information and answer questions about the form or your coverage.

What are the penalties for not filing Form 1095-B?

The IRS may impose penalties for not filing Form 1095-B. Generally, if you do not file the form or provide incorrect information on your return, you may be subject to a penalty of $50 per failure up to an annual maximum of $260,000. It’s important to note that this penalty only applies if you fail to file the form without reasonable cause.

Conclusion

Form 1095-B can seem daunting, but breaking it down into smaller components will simplify the filing process. Qualifying citizens, employers, insurers, and other health providers must provide proof of coverage on Form 1095-B. Ensure you receive your correct and complete form to file and report accurately. Lastly, if you are still waiting to receive your form, which needs to be completed or corrected, take the appropriate steps to remedy the situation.