Are you familiar with the concept of an asset class? Understanding what an asset class is and how it works can be beneficial in helping to grow your finances. Investing in different asset classes can diversify a portfolio and generate higher returns over time.

In this blog post we will discuss what an asset class is, explain why they are important when building wealth and highlight some examples of common types of investment assets. By the end of this article, you should better grasp the basics of various categories of investments and how they work together.

Defining Asset Classes and Why It Is Important to Understand Them

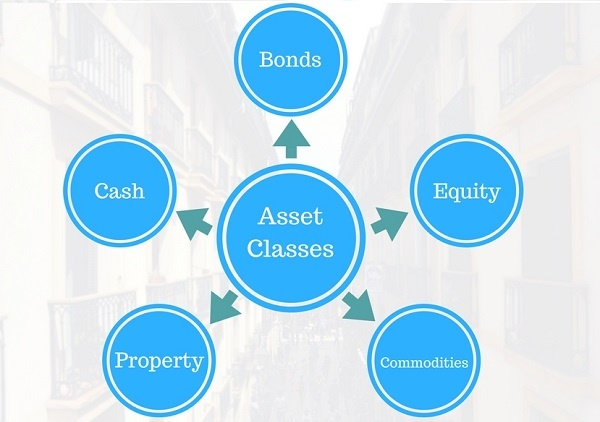

An asset class is a group of similar investments that behave similarly in the market. Investors own asset classes and generate income from dividends, interest, or capital appreciation. Assets within a class often share certain characteristics such as risk level, liquidity, and return potential. By investing in various asset classes, investors can create a diversified portfolio that helps to minimize risk while maximizing returns.

Understanding asset classes is important for investors because it allows them to create a well-structured portfolio that can help reduce the volatility of investments and increase their potential gains over time. Different asset classes have varying risk and return potential levels, so understanding how these types of investments work together can benefit investors.

Types of Common Asset Classes

1. Stocks

A stock is a type of security representing ownership in a company and typically pays dividends or increases in value over time. It is important to consider the risk associated with stocks, as they are subject to market fluctuations and can sometimes be unpredictable.

2. Bonds

A bond is a type of debt security in which an investor lends money to an entity, usually a company or government, for a set period and receives regular interest payments. The risk associated with bonds varies depending on the issuer.

3. Cash Equivalents

These include investments such as money market accounts, certificates of deposit (CDs), and treasury bills, all considered low-risk investments with predictable returns.

4. Real Estate

This asset class includes buildings, land, and leases of any kind. Investing in real estate can provide a steady income stream, but investors should know that it is subject to market conditions, taxes, and other regulations.

5. Commodities

These are physical items such as gold and silver, agricultural products, or energy sources that can be bought or sold in the futures markets. They are typically used as hedges against inflation or to diversify a portfolio.

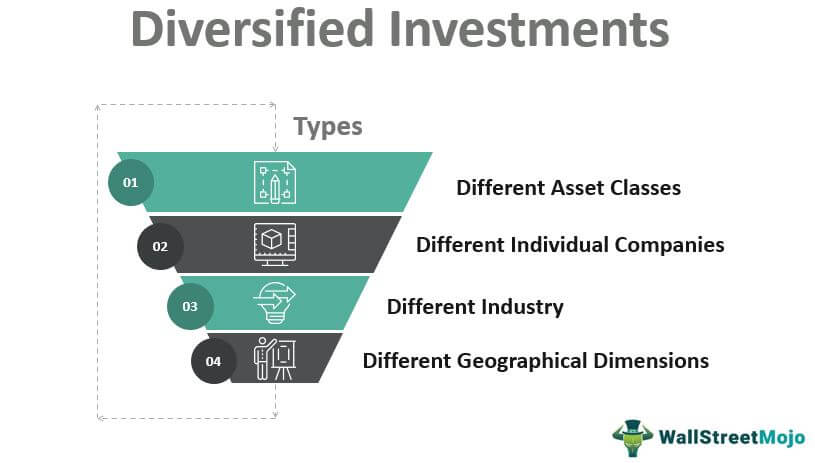

Diversifying Your Investments with Different Asset Classes

Investing in different asset classes can create a well-diversified portfolio that helps minimize risk and increase returns over time. Different asset classes have varying risk and return potential levels, so understanding how they work together is important when building a portfolio.

Additionally, by diversifying investments across multiple asset classes, investors can reduce the volatility of their portfolios and create a well-structured plan that aligns with their financial goals.

Benefits of Investing in Different Asset Classes

1. Diversification: Investing in multiple asset classes can reduce a portfolio's overall risk and help smooth out returns over time.

2. Risk Reduction: By diversifying your investments across different asset classes, you are less likely to experience drastic losses in any one particular area.

3. Higher Returns: Investors can generate higher returns over time by taking advantage of different asset classes.

4. Long-Term Growth: Investing in various asset classes can help ensure long-term growth and stability for your investments.

5. Tax Benefits: Some asset classes may have tax advantages that can help you save money.

6. Professional Management: Investing in professionally managed funds specializing in different asset classes can help ensure that your investments are properly diversified and managed to maximize returns.

7. Portfolio Rebalancing: Rebalancing a portfolio regularly helps align it with your financial goals and objectives.

8. Reduced Volatility: By investing in different asset classes, an investor can reduce the volatility of their portfolio and help protect against large losses during market uncertainty.

9. Accessibility: With investments such as stocks, bonds, mutual funds,d ETFs, it is easier than ever to access various asset classes.

10. Liquidity: By investing in liquid assets, investors can easily access their money when needed without incurring high costs or penalties.

Risks and Rewards of Investing Across Multiple Asset Classes

Investing across multiple asset classes is one of the most effective ways to diversify a portfolio and reduce overall risk. By investing in different asset classes, investors can take advantage of different growth opportunities and protect their investments during market volatility. Although investing across multiple asset classes reduces risk, it carries certain risks.

One risk associated with investing across multiple asset classes is the potential for higher administrative costs. This is because when investing in different types of investments, there are more transactions, and paperwork may need to be processed. Additionally, since different asset classes can have varying levels of return potential and volatility, some investors may be tempted to take on too much risk in pursuit of higher returns.

However, the rewards of investing across multiple asset classes can often outweigh the risks. By diversifying your investments across different asset classes, you can reduce the overall risk of your portfolio and generate higher returns over time. Additionally, investors can reduce their costs by taking advantage of tax benefits associated with some asset classes and professional management services and help maximize returns.

FAQs

Q: Why Are Asset Classes Important?

A: Asset classes are important for investors because they provide diversification. Different asset classes may perform differently in different market environments, allowing investors to spread their money around to benefit from a range of potential returns. Diversifying across asset classes also helps reduce risk as you are less exposed to any one type of investment.

Q: What Are Some Examples of Asset Classes?

A: The primary asset classes are stocks, bonds, commodities, real estate, currencies, and cash equivalents. Stocks represent company ownership and can generate returns through dividends or capital appreciation. Bonds are debt instruments issued by governments or corporations that pay interest over time. Commodities are tangible goods such as oil, gold, or wheat that can be bought and sold. Real estate is land and buildings used for investment purposes. Currencies are the money of different countries that can be exchanged or traded. And finally, cash equivalents include short-term investments with high liquidity, such as savings accounts or money market funds.

Q: What Is a Diversified Portfolio?

A: A diversified portfolio includes investments from different asset classes and sectors and different types of investments within each class. This helps reduce risk by spreading your investments, so you’re not overly exposed to any particular market or sector. Creating a diversified portfolio can also help maximize returns over time by taking advantage of different market cycles. A well-balanced portfolio will allow you to take advantage of potential opportunities.

Conclusion

Investing in different asset classes can diversify and strengthen your portfolio while potentially providing higher returns. By understanding the basics of each asset class, you will be better equipped to build a well-balanced portfolio that fits your financial goals and investing style. It is important to note that investing involves risk, so it is important to do your research and make sure that each investment is suitable for your risk tolerance. With the right mix of investments, you can benefit from a diversified portfolio that will help grow your wealth over time.