Are you debating investing in Tesla stock? You're not alone – the company has been one of the most discussed stocks of the year. After an incredible run-up this past summer, Elon Musk's electric car manufacturer is a favorite for investors looking for sky-high rewards and stunning share growth. But before making any investment decisions, you must understand all angles of investing in Tesla stock.

In this post, we'll walk through some of the biggest risks associated with buying into Tesla so you can decide whether it should be part of your portfolio. Let's dive in!

Introducing Tesla Stock

Tesla stock has been one of the hottest stocks this past year, with shares increasing by more than 600% since January 2020. Several investors are attracted to Tesla's innovative electric cars, their growth potential, and wild share price swings.

But before investing in any company, it is important to understand the risks associated with that investment. This post will discuss some of the biggest risks when investing in Tesla stock so you can make an informed decision.

What is the Risk-Reward Profile of Tesla Stock?

Tesla stock has the potential to be a lucrative investment, but it is important to understand that its risk-reward profile differs significantly from most other stocks.

Tesla is valued higher than any other car manufacturer in the world, and its share price can rise or fall quickly due to news about the company, demand for electric cars, or the performance of its competitors. Tesla stock may be a good bet for investors looking for quick returns, but those looking for a long-term investment should consider its risks.

Potential Risks Associated With Investing in Tesla Stock

1. Tesla is a High-Risk Investment: Because of its high valuation, its share price can be extremely volatile and risky. If you are considering investing in Tesla stock, it is important to understand that your money could be at risk if the company does not perform as expected.

2. Model 3 Production Issues: Tesla has recently faced production issues with its Model 3, which could hurt profit margins and its stock price.

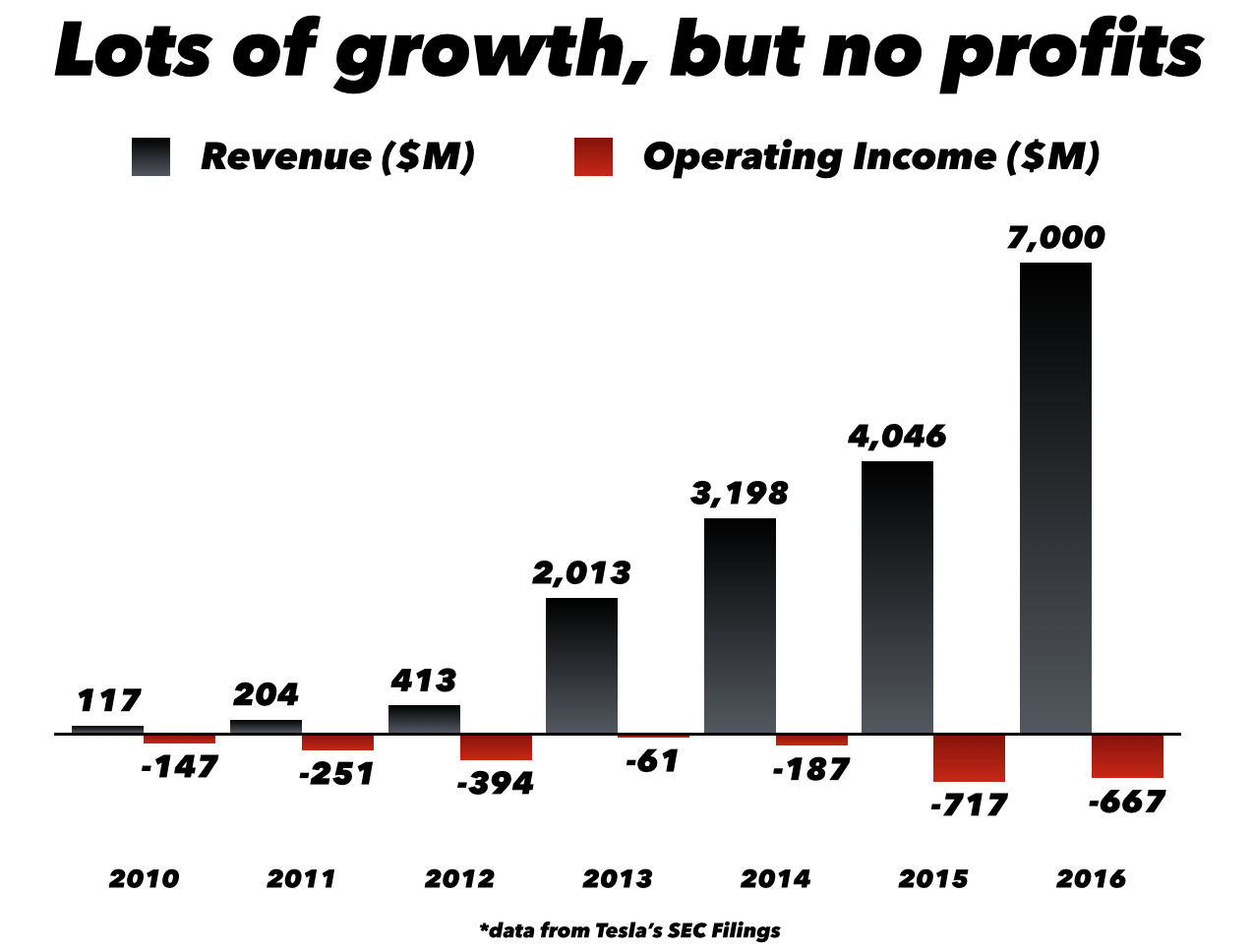

3. Financial Stability: As Tesla is a young company, there are questions about its financial stability and long-term prospects. Investors should be aware that Tesla's stock price may remain low.

4. Elon Musk's Unpredictable Behavior: Tesla's CEO, Elon Musk, is known for his unpredictable behavior and statements, which could hurt the company's stock price.

Key Factors Affecting Tesla's Performance and Value

1. Production Volume Growth: Tesla's success depends on its ability to scale up the production of its cars to meet customer demand and keep prices competitive. Any failure to do so could lead to a significant drop in share price, as investors will become concerned about the company's prospects.

2. Executive Leadership: As a technology-driven company, Tesla must have a strong team of executives and engineers who can successfully navigate the ever-evolving automotive industry. Any change in leadership or key personnel could adversely impact operations.

3. Competition: The electric car market is highly competitive, and many major automotive manufacturers are investing heavily in their EV offerings. Tesla's current market dominance could be threatened by the entry of well-funded competitors, leading to a decrease in share value.

4. Energy Storage: Tesla is investing heavily in energy storage solutions such as batteries and solar panels, which are expected to generate significant revenues in the future. Tesla's share price could suffer if product demand disappoints or costs exceed projections.

Analyzing the Competitive Environment Surrounding Tesla Stock

When purchasing Tesla stock, it's important to consider the competitive environment in which it operates. Although Tesla leads the electric car market, other companies are vying for a piece.

This includes traditional automakers like General Motors and Volkswagen and tech startups like Rivian and Lucid. Understanding how these companies compare to Tesla regarding technological capabilities, production capacity, funding, and more is essential.

Additionally, it's important to consider the impact that government subsidies for electric cars could have on Tesla's overall business.

Short-Term vs. Long-Term Investing in Tesla Stock

Tesla stock is best suited for investors who have a longer-term outlook. The company's share prices fluctuate wildly in the short term, especially when news breaks about potential production delays or new product launches. If you plan to buy and sell Tesla shares in weeks or months, you may lose money.

However, long-term investors willing to ride out the turbulence may be rewarded handsomely. Tesla's share price has risen steadily since its 2010 IPO, and many top analysts predict that this trend will continue in 2020 as Tesla begins to scale up the production of its electric vehicles and penetrate new markets with its products.

With a long-term outlook, Tesla stock could be a lucrative investment for those willing to hold onto their shares and weather the occasional storm.

Preparing for a Potential Market Correction and Managing Risk with Tesla Stock

Like all investments, there is no guarantee that Tesla stock will continue to rise. It's important to know the potential risks associated with investing in Tesla stock and plan to manage them.

One of the most important things you can do is to prepare for a potential market correction by diversifying your portfolio. If you choose to invest in Tesla, make other investments — such as bonds, mutual funds, or index funds — so you're not overly exposed to any stock.

Diversifying your portfolio can help reduce the risk of a sudden drop in Tesla's share price and ensure you don't lose all of your money in a worst-case scenario.

FAQs

Is it profitable to buy Tesla shares?

Tesla shares have been profitable for many investors. The stock has seen a meteoric rise in the past year, and who knows how far it can go? But investing in Tesla is also risky as there are certain risks associated with buying into Tesla's stock that should be considered before making an investment decision.

Some of these risks include Tesla's lack of profitability, volatility in stock price, and dependence on government incentives. Additionally, it is important to remember that past gains do not guarantee future success, so do your due diligence before investing in any company.

Is Tesla's share good for the long term?

Tesla stock can be a great long-term play. The company is at the forefront of electric car technology and has seen tremendous success this past year, leading to incredible share growth.

That said, investing in Tesla long-term requires patience and understanding the risks associated with buying into its stock. As discussed above, Tesla has yet to profit and relies on government incentives.

Does Tesla stock have a future?

The future of Tesla shares is uncertain, although investors have seen substantial returns this past year. It's important to remember that any stock can experience volatility, losses, and gains - so do your research before investing in Tesla stock or any other company.

Additionally, the fate of Tesla's success ultimately depends on the continued success of the electric car industry and its ability to develop new technologies. But if you're willing to take a risk, the potential for gains with Tesla stock is certainly there.

Conclusion

Investing in Tesla stock certainly has risks, but it can still be an attractive option for investors looking to achieve substantial returns when you factor in their potential rewards and long-term growth potential. Even with the risks involved, Tesla could be a good fit if you're willing to gamble on a high-risk stock.

Make sure you do your homework and understand the potential risks before investing. With an educated decision and some luck, Tesla stock could be a great addition to your portfolio. Good luck in your journey as an investor!