Are you looking for a way to measure how much debt you have compared to your income? Calculating your Debt-to-Income (DTI) ratio can give you insight into your financial health and help you determine if it's time to make adjustments.

A high DTI indicates that too much of your monthly income is being dedicated to a loan or credit card payments, making it difficult or impossible for other financial goals such as retirement or emergencies.

Understanding this simple metric is essential when planning and managing personal finances - read on to learn how to calculate your DTI Ratio!

What is a Debt-to-Income (DTI) Ratio, and why is it important to know your number

A Debt-to-Income (DTI) Ratio is a calculation that helps you understand how much of your monthly income goes toward loans, credit cards, and other debt payments. Knowing your DTI ratio is important because it gives you insight into whether or not you are in a financial position to take on more debt.

A high DTI ratio indicates that too much of your income goes towards debt payments, making it difficult or impossible for other financial goals such as retirement or emergencies.

Calculating your Debt/Income Ratio is easy - all you need

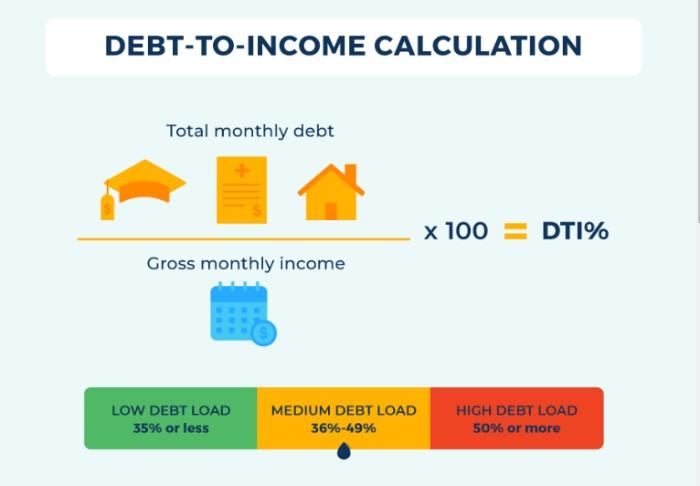

Calculating your Debt/Income Ratio is easy. All you need to do is gather information on your monthly income and regular debt payments, then divide the amount of debt by the amount of income.

First, add up your monthly debt payments, including student loans, credit card payments, and other loans. Then, add up all of your monthly income, including any salary or wages, interest or dividend income, Social Security benefits, or any other source of income.

Next, divide the total debt amount by the total income to calculate your Debt-to-Income Ratio. For example, if your monthly payments are $1,500 and your monthly income is $4,000, your Debt/Income ration would be 37.5%.

Your DTI ratio will help you understand how much of your income is going towards debt and whether or not it’s time to make adjustments. Generally, a DTI ratio of 36% or lower is considered healthy.

A higher number may indicate that too much of your income is being spent on debt payments and could be a warning sign that it’s time to adjust your spending habits.

In addition to helping you understand your financial health, knowing your Debt-to-Income Ration can also be useful when applying for a loan or getting approved for credit.

Lenders typically look at your DTI ratio to help them determine how much debt you can handle and if you’re a good candidate for the type of credit they offer.

Factors that can impact your DTI ratio

Your Income - The debt you owe will be compared to the total income you generate each month. A higher income means more is available to pay off the debt, resulting in a lower DTI ratio. Additionally, if you receive an increase in your salary or other sources of income, it could help improve your overall financial health by reducing your DTI ratio.

Credit Utilization refers to how much credit you use compared to your available credit. A high utilization rate suggests that you are relying too heavily on credit which could hurt your score, leading to an increased DTI ratio.

Number of Accounts - This is your total number of accounts, including everything from credit cards to mortgages and car loans. The more accounts you have, the higher your DTI ratio will be since there are more financial obligations to consider.

Debt Repayment History - Your repayment history greatly impacts your Credit Score and can also affect your DTI ratio. If you're making regular payments on time every month, it's a good sign that you can manage debt responsibly and help keep your DTI in check.

By understanding how these factors can influence your Debt-to-Income ratio, you can make adjustments to ensure that your finances remain healthy and that you remain on track to achieving your financial goals.

Benefits of having a low DTI ratio

The benefits of having a low Debt-to-Income (DTI) ratio include the following:

- Increased ability to qualify for new credit. A lower DTI ratio demonstrates to lenders that you have more financial flexibility and can make payments on time, which makes it easier for you to obtain loans or other forms of financing.

- Lower interest rates. A low DTI ratio often results in lower interest rates on new loans, meaning you will pay less over the life of your loan.

- Improved credit score. A low DTI ratio helps improve your credit score, showing lenders that you are responsible with money and can manage debt responsibly.

- More disposable income is available for other expenses. When much of your income is not dedicated to paying off debts or loans, you will have more monthly money for other necessities or goals, such as emergency savings or retirement accounts.

- More freedom to make purchases without taking on additional debt. With a lower DTI ratio comes more financial flexibility - you can make discretionary purchases without worrying about additional debt.

- Reduced stress and improved peace of mind. A low DTI ratio means less debt, which can reduce feelings of stress and give you greater peace of mind about your financial situation.

- Tax savings from deductible interest payments. Depending on the loan or credit card payment type, your interest payments may be tax deductible - meaning you will get some extra cashback to come tax season!

- Increased ability to save money for future investments and expenses. With more disposable income available each month, saving money towards larger, long-term financial goals such as retirement accounts or college tuition bills for kids or grandkids down the line becomes easier.

Steps you can take if you have a high DTI ratio

If you have a high DTI ratio, there are several steps you can take to bring it down and improve your financial health.

First, prioritize your debt by paying off the loans with the highest interest rates first. This will maximize the money saved and help you pay off your debt faster.

Second, create a budget and track your spending with apps or services like Mint or You Need A Budget so you can more easily identify areas where you could be making changes to reduce your expenses.

Lastly, consider increasing your income by taking on part-time work or a side hustle.

FAQs

What is a good debt-to-income ratio?

A good debt-to-income ratio is considered to be 36% or less. At most, 36% of your income should be dedicated to debts, such as loan and credit card payments.

What are the consequences of having a high debt-to-income ratio?

Having a high debt-to-income ratio can be detrimental to your financial health. A high DTI can limit your ability to get approved for certain loans, such as a mortgage.

Additionally, it can make it difficult or impossible to save for retirement or other financial goals.

Are there any exceptions to the debt-to-income ratio calculation?

Yes, there are some exceptions. For example, student loans typically have different debt-to-income guidelines. Additionally, other forms of debt, such as home equity loans, may have different DTI requirements.

Conclusion

It’s important to know your debt-to-income ratio. This easy calculation lets you know if you are in a good financial situation or need to make changes. It can also benefit you when applying for loans because having a low DTI ratio generally means better loan terms. If you have found that your DTI is too high, then take the necessary steps to reduce it as soon as possible.