Do you wonder how money grows over time? If you manage your investments, you have heard of the concept of compounding. However, did you know there is a type of compounding known as discrete compounding?

Discrete compounding can provide greater returns if used strategically; however, it comes with risks and benefits.

Let's explore discrete compounding and what opportunities it may offer investors who wish to pursue this approach in their investment strategies.

Defining Discrete Compounding

Discrete compounding can be defined as calculating interest periodically on the original principal amount of cumulative earned interest rather than continuously.

This approach to compounding is called "discrete" because it occurs over a series of discrete periods, such as annually, semi-annually, quarterly, or monthly.

Anytime the rate of return from your investments is calculated and applied more than once, you use discrete compounding.

How Discrete Compounding Works

Discrete compounding works by taking the principal amount of your investment and multiplying it by the interest rate for each period, then adding the results together over several periods and reinvesting them. This means that when using discrete compounding, you earn interest on your accumulated interest from previous periods.

For example, let's say you invest $100 at an annual interest rate of 4%. At the end of the first year, your initial investment will have grown to $104 (the principal plus 4%).

If you reinvest this amount and continue receiving 4% each subsequent year, your investment will grow to $108.16 after the second year ($104 x 4% = $108.16).

This continuous accumulation of returns over time is known as compounding, and discrete compounding allows you to take advantage of this process by reinvesting your earnings at regular intervals.

The Benefits of Discrete Compounding

1. Higher rate of return – Discrete compounding yields a higher rate of return than simple or continuous compounding since the interest is calculated more often.

2. Increased liquidity – Investing in instruments that yield a higher rate of return also means increased liquidity, as the returns are greater and can be accessed more quickly.

3. Greater potential for growth – With discrete compounding, there is the potential for your investments to grow faster than with traditional compounding schemes since interests are being added more frequently.

Risk Factors Associated with Discrete Compounding

1. Higher fees – Due to the increased complexity of discrete compounding, higher fees may be associated with this compounding than traditional methods.

2. Less predictability – With traditional compounding, you can easily predict the rate of return you will receive. However, with discrete compounding, the rate of return may be more difficult to calculate due to its complexity.

3. Market volatility – As with any investment, there is always a risk that market conditions could change, affecting the rate of return you receive from your investments. Therefore, knowing the market conditions before investing in any discrete compounding scheme is important.

Discrete compounding can offer investors a great opportunity to increase their returns, but it also comes with certain risks that should be considered before undertaking this approach.

To maximize the potential benefits and minimize risks associated with discrete compounding, it is important to have a thorough understanding of the process and the market conditions, and associated fees.

How to Calculate Discrete Compounding?

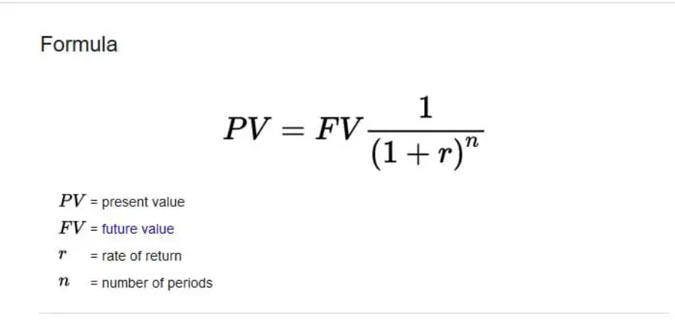

Calculating the rate of return from discrete compounding is complex and requires knowledge of the period, beginning balance, interest rate, and compounding frequency. The formula to calculate returns from discrete compounding is as follows:

FV = PV (1 + r/n)^ (n x t)

FV is the future value, PV is the present value, r is the interest rate, n is the number of compounding periods, and t is the period. For example, if you have an initial investment of $1000 and a 10% annual interest rate with monthly compounding, the formula would be:

FV = 1000 (1 + .1/12)^ (12 x 5) = $1443.17

As you can see, the number of your returns from discrete compounding will depend on several factors, such as the interest rate, compounding frequency, and period. With this in mind, it's important to consider all available options carefully before investing in a discrete compounding scheme.

Different Types of Investments That Use Discrete Compounding

1. Savings Accounts - These are some of the most basic investments and can offer a consistent rate of return over time through regular discrete compounding.

2. Bonds - These long-term debt instruments can also use discrete compounding to calculate their returns, allowing investors to benefit from increased interest payments over time.

3. Mutual Funds - Mutual funds use discrete compounding to calculate the returns of their underlying holdings, allowing investors to benefit from regular income streams that increase over time.

4. Exchange Traded Funds (ETFs) - These pooled investments are similar to mutual funds and can use discrete compounding to calculate their returns.

5. Commodities - Commodities can be traded in various ways, and some investors use discrete compounding to calculate the gains from their trades.

Alternatives to Discrete Compounding

1. Continuous Compounding - Some investments use this method and can offer higher returns over time but with more risk, as it assumes that the rate of return will remain constant.

2. Variable Rate Compounding - This approach allows investors to choose a variable rate of return that may change over time based on market conditions or investor preference.

3. Leveraged Investing - Leveraged investing allows investors to use borrowed money to increase their potential gains and increases the risks associated with any losses.

Discrete compounding can allow investors to maximize their returns over time by carefully managing investments and strategic decisions. However, investors should take caution when using this methodology, as its risks can be substantial.

FAQs

What is the difference between discrete and continuous compounding?

The primary difference between discrete compounding and continuous compounding is the frequency of compounding. With discrete compounding, the interest rate is calculated and added to the principal amount at predetermined intervals, such as monthly or quarterly.

On the other hand, continuous compounding does not have any predetermined intervals but instead continually compounds the interest rate. This can result in money earned over time due to the continuous compounding of interest rates.

What is continuous compounding?

Continuous compounding is continually adding interest to a principal amount over time. This type of compounding is often used in investments as it can result in higher returns than discrete compounding.

With continuous compounding, the frequency of compounding is not predetermined; rather, the interest rate is continuously added to the principal amount.

What is an example of discrete compounding?

An example of discrete compounding is when an investor sets up a monthly savings account that compounds the interest rate. In this scenario, the investor deposits a certain amount of money into the account, and each month, the interest rate is calculated and added to the principal amount.

This allows consistent, regular interest to be earned on the money in the account.

Conclusion

Discrete compounding can be an effective strategy for investors who wish to increase their returns with minimal risk. It also serves as an important tool for budgeting, helping people set and reach long-term financial goals.

Understanding how this type of compounding works is key to taking full advantage of its potential benefits, so those interested in pursuing this strategy must take the time to educate themselves and consider whether or not it is right for them. With careful planning and research, discrete compounding can provide investors with valuable returns over time.