Are you tired of running to the bank every time that paycheck comes in? Have you ever misplaced an important paper check and struggled to get money in your account on time? If these situations sound familiar, direct deposit may be an excellent option.

Direct deposit is a tool many professionals use daily to have their paychecks deposited directly into their bank accounts without having to physically visit financial institutions, often increasing convenience and reliability. Let's look at exactly what direct deposit is and why it can be so useful when managing your finances!

Define direct deposit and how it works

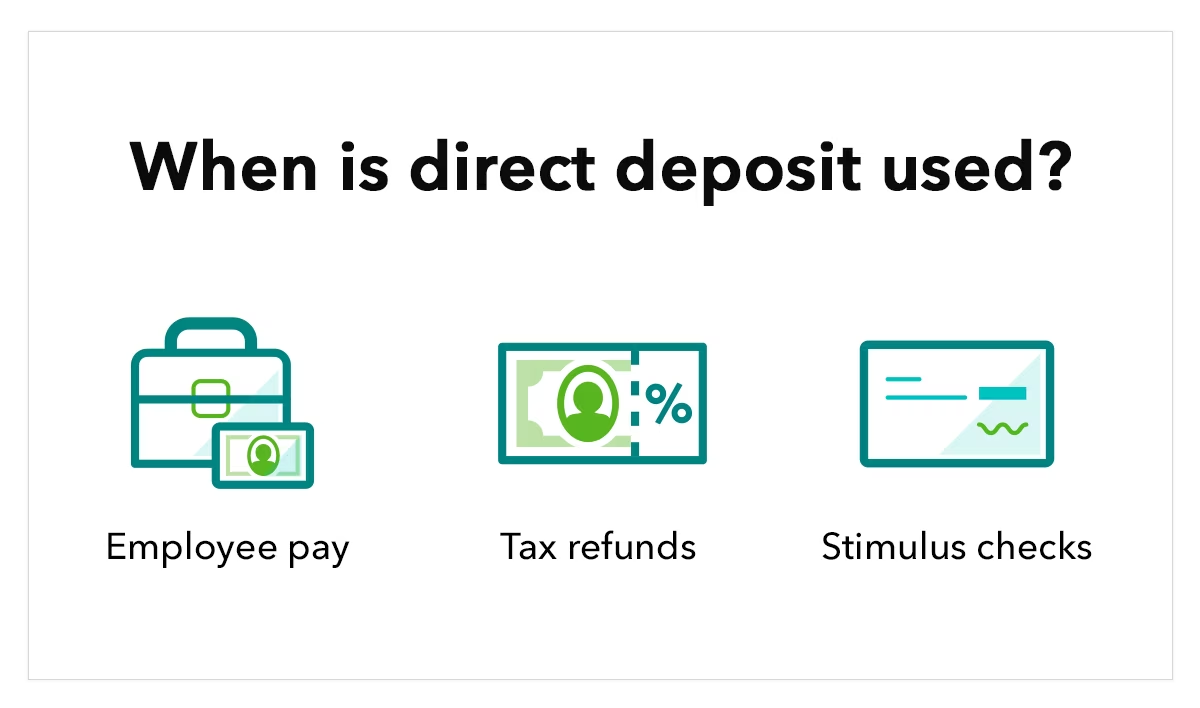

Direct. deposit is an automated system that electronically transfers funds from an employer or other source into a designated individual’s bank account. This means that the money will usually arrive in the account quickly, securely, and without any additional effort on behalf of the payee. Direct deposits are also sometimes called electronic funds transfers (EFT).

Direct deposits begin when an individual provides their bank routing and account numbers to the employer or other payor. The employer will then initiate a payment order via its banks, sent through the Automated Clearing House (ACH) network. This network verifies that all details are correct before transferring the funds from one account to another.

This process is generally completed within one to three business days, depending on the transfer size and the banking institutions involved.

Direct deposits have many advantages over traditional paper checks, such as increased convenience and reliability. With direct deposit, payees no longer need to worry about misplaced or lost paper checks; instead, they can rest easy knowing that their funds are available in their accounts quickly and securely. Furthermore, direct deposits can help reduce check cashing fees incurred by those who may need access to traditional banking accounts.

Advantages of using direct deposit

Using direct deposit has many advantages when it comes to managing your finances. With direct deposit, you'll never have to worry about missing a check or waiting in line at the bank. Instead, money will be securely transferred into your account once your employer releases it.

Direct deposits also provide increased reliability compared to traditional paper checks. This ensures that money is delivered to the right account on time, reducing the risk of lost or misplaced checks.

Direct deposits also provide increased convenience by removing the need to manually deposit funds into your account each payday. You can rest assured that your money will be securely transferred into your account as soon as it is released from your employer.

In addition to increased convenience and reliability, direct deposits can help reduce check cashing fees incurred by those needing access to traditional banking accounts. This is especially beneficial for those who lack a bank account or are in a situation where receiving funds via direct deposit is more convenient than visiting a bank.

Steps to setting up direct deposit

Setting up direct deposits is typically easy. First, you must provide your banking information (routing and account numbers) to your employer or another payor. Once the details are received, the payor will initiate a payment order via its banks which is then sent through the Automated Clearing House (ACH) network. After verifying the information, funds will be transferred from one account to another.

The entire process usually takes up to three business days. Once the money is successfully transferred, you'll receive a confirmation email or statement from your bank notifying you that the funds have been received and deposited into your account. It's important to keep this confirmation as it may be needed for proof of payment.

Understanding the fees associated with direct deposit

When signing up for the direct deposit, knowing any associated fees is important. Depending on the financial institution, there may be a fee for setting up and using direct deposits. Some banks may also offer incentives such as higher interest rates or waived monthly service charges when opting into direct deposits. It’s important to know all associated fees before signing up for a direct deposit to ensure it is the right choice.

Overall, direct deposits provide increased convenience, reliability, and security when it comes to managing finances. With the simple steps outlined above, setting up direct deposits can be a breeze. Be sure to review any associated fees before signing up and benefit from direct deposit's convenience.

Common concerns about security and privacy when using direct deposit

Regarding managing finances, security and privacy are always top of mind. Rest assured that direct deposits provide increased security compared to traditional paper checks. This is because funds are transferred directly from one account to another through secure networks - making it much more difficult for someone else to access or fraudulently use your money.

Additionally, direct deposits are only accessible by the payor and receiver. This helps protect your data from any third parties looking to access or misuse it.

Tips for managing your finances when utilizing direct deposits

When using direct deposits, it’s important to review your statements regularly to ensure that all funds sent from a payor have been correctly deposited. Additionally, keep track of any fees associated with direct deposits, as these can add up over time. Finally, it’s also important to ensure that the account you use for direct deposits is well-managed and that your funds are in good standing.

By following these tips and understanding the features of direct deposit, you can take advantage of this convenient tool while staying on top of your finances.

FAQs

Q: How Do I Set Up Direct Deposit?

A: Setting up direct deposit is usually a quick and easy process. You will need to provide your employer or another payer with specific information about your bank account, such as the bank’s routing and account numbers. Once you supply this information, the funds will be deposited directly into your account. It is important to note that the process may vary depending on who is providing the funds, so it is best to check with your employer or another payer for specific instructions.

Q: Is Direct Deposit Safe?

A: Yes! Direct deposit is a secure and reliable way to transfer funds electronically. Banks take great care in protecting your personal data and financial information. Furthermore, direct deposit deposits are available immediately when the employer or other payer sends themthemmaking it a convenient opfor both employers and employees.

Q: What Are the Drawbacks of Direct Deposit?

A: While direct deposit offers many advantages, it can have drawbacks. Many banks may require a minimum balance to be maintained to take advantage of direct deposit. Additionally, if you are transferring funds from an international bank or another payer, additional fees and charges may be associated with the transfer. Finally, it is important to ensure that your bank account information is correct and up-to-date so that your deposits arrive on time.

Conclusion

Direct deposit is an excellent tool for managing finances. It is convenient, reliable, and secure, making it a popular choice among many individuals and employers. However, it is important to understand any associated fees and review your statements regularly to ensure funds are correctly deposited into your account. Following these steps, you can take advantage of direct deposit and make the most of this useful resource.