Do you use online banking? Are you interested in understanding the technology behind secure and accurate payment processing? If so, you've come to the right place.

In this blog post, we will discuss what a magnetic ink character recognition (MICR) line is and how it ensures your financial transactions are securely processed.

With its sophisticated security measures, MICR technology enables banks to quickly verify check payments—a fundamental component of modern digital banking systems today.

Learn more about this fascinating subject as we dive into what makes up a MICR line!

Introducing the concept of MICR and its importance in banking

A Magnetic Ink Character Recognition (MICR) line is an advanced technology used to securely and accurately process payment transactions. It is widely used in banking and other financial institutions, allowing them to verify checks quickly for payment processing.

It is important to banks because it helps them reduce the concerns of fraudulent transactions and data entry errors. Banks can easily read and verify the information written on a check using MICR technology without human intervention. This speeds up payments and increases banking operations' overall accuracy and security.

Understanding the components of a MICR line

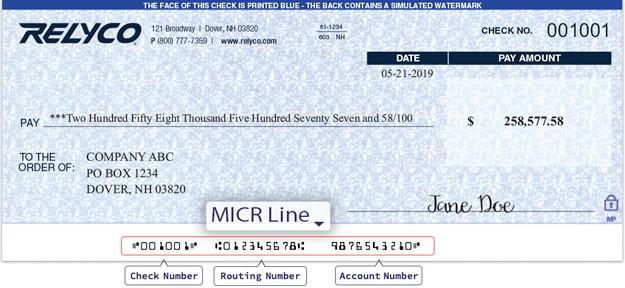

Magnetic Ink Character Recognition (MICR) line typically consists of three components – the routing number, account number, and check number. These are encoded in specially-formatted magnetic ink characters, which an automated system can read.

The routing number is a nine-digit code that identifies the financial institution where the account is held. The first two numbers of this code indicate the region in which it was issued. For example, if an account holds a routing number beginning with 01, this means the account is associated with a bank in New England.

The second component of the MICR line is the account number itself. Depending on the financial institution, this can range from five to seventeen digits. The check number is the line's last component and helps track which transaction belongs to which customer.

Banks can quickly and accurately process payments with minimal human interaction using this MICR technology. Since it is an automated system, the chances of errors due to manual input are eliminated. Additionally, since the code is printed in magnetic ink, it is more secure than paper checks and can be read by computers even in low-light environments.

How the MICR line is used to process checks

The MICR line is read by special machines that allow banks to quickly verify customer information and approve transactions without manual checking. This makes the payment process faster and more efficient, ensures accuracy, and prevents fraud.

A computer or specialized reader scans the MICR line to capture the data automatically. This information is then compared to the customer's records to verify that the funds come from a valid source. Banks can quickly identify the check issuer and ensure payment to the correct account using this technology.

To further protect against fraud, many banks also use a special type of magnetic ink called “E13B,” which contains additional characters (such as numbers or symbols) that are difficult to counterfeit. This helps prevent criminals from making false payments by using fake checks.

The MICR line is a powerful security feature banks use to quickly and securely process check payments. Thanks to its sophisticated technology, financial institutions can quickly identify fraud attempts and ensure customers receive their funds promptly. With its help, digital banking systems are more efficient and reliable than ever!

Benefits of having a MICR line on checks:

- MICR lines provide an added layer of security to check payments, as the data encoded in the line can be read and validated by banks before processing a transaction. This helps ensure that checks are not forged or counterfeit.

- The technology is fast, efficient, and accurate. Banks can scan and process thousands of checks in a matter of minutes with this technology, and it can accurately read and decode the MICR line every time.

- It is cost-effective, as banks don’t need to manually process check payments and can save on labor costs.

- MICR lines help reduce fraud significantly by providing an extra layer of security and accuracy in processing check payments.

- It eliminates human error, as the data encoded in the lines can be read reliably by machines without any manual intervention.

- The technology is highly reliable and durable, which helps banks ensure that checks are not processed with inaccurate or outdated information.

- It enables banks to process check payments quickly and accurately, which in turn helps reduce wait times for customers.

- MICR lines provide a standardized system of encoding data on checks, which helps ensure the accuracy of transactions across different banking systems and institutions. This makes it easier for financial institutions to cross-check information about check payments.

Common Mistakes To Avoid When Using a MICR Line

Using the Wrong Font

The magnetic ink character recognition (MICR) font used for printing a MICR line must be specifically designed for use with MICR technology. Standard fonts used in everyday printing won’t work, so always use the correct font.

Using substandard MICR Ink

The ink used for printing a MICR line must meet certain quality standards to be accurately read by machines. Use quality MICR ink designed specifically to create a clear, readable MICR line.

Printing the Wrong Characters

The numbers and symbols appearing on a MICR line must be precise to read accurately. Double-check to ensure that no characters are incorrect or out of place.

Printing Incorrect Characters on the MICR Line

In addition to printing the correct characters, it is important to ensure that any numbers or symbols appearing on the MICR line are entered correctly. Always check for typos before submitting documents with a MICR line for processing.

Steps for setting up a valid MICR line on checks

1. Ensure that the font used is OCR-A or E13B. This law ensures that all MICR code fonts are uniform and easily readable by machines.

2. Make sure the ink is magnetic or “mag.” This specialized ink contains particles that allow machines to easily read and decode information printed on checks.

3. Utilize a MICR encoding machine to print the data onto the check using the correct font and ink type. This ensures accuracy and consistency with all checks processed.

4. After the MICR line is printed onto the check, it must be tested to ensure accuracy and compliance with ABA standards. This can be done using a special MICR reader, which reads and detects errors in the line’s format or content.

FAQs

How is a MICR line different from a regular text line?

A MICR line is not just a regular text line. A MICR line contains special characters recognized and read by machines, making it much more secure than a typical text line.

Are there any disadvantages to using a MICR line?

The main disadvantage to using a MICR line is that it requires specialized equipment and software, which can be costly. Additionally, if the MICR characters are not printed correctly, the system cannot read them properly, and the transaction will not be completed. This can cause delays in processing payments.

Where can I find more information about MICR lines?

You can find a wealth of information about MICR lines online. It is always best to consult with professionals when making financial decisions, so be sure to speak with your bank or payment processor for more specific guidance on how to use MICR technology.

Conclusion

Now that you understand the concept of the Magnetic Ink Character Recognition (MICR) line, its components, and how it allows checks to be processed into the banking system, you can now appreciate its benefits. Understanding common mistakes and steps toward setting up a valid MICR line will help you ensure accuracy.