Are you looking for a way to diversify your portfolio and invest in the total stock market without picking individual stocks? Total Market Index Funds are one of the best options available. They offer investors broad exposure across all markets, including large and small capitalization companies, making them an excellent choice for long-term investment goals.

In this blog post, we'll break down some of the best total market index funds today – their advantages and drawbacks, where they can be purchased, and how much potential return each fund offers. Keep reading to learn more!

What is a Total Market Index Fund and How Does it Work

A total market index fund is an investment strategy that seeks to replicate the performance of a broad stock market index. Unlike other types of funds, it does not select individual stocks but instead invests in all the stocks within its target benchmark.

This approach exposes investors to the overall stock market in a single purchase and eliminates the time spent researching and selecting individual stocks.

Total market index funds typically track a benchmark such as the S&P 500, Dow Jones Industrial Average, or Wilshire 5000. These benchmarks are composed of hundreds of stocks from different sectors, industries, and sizes of companies.

Total market index funds offer broad diversification and low-cost investments with minimal tracking error by simultaneously investing in all these components.

Comparing Different Types of Total Market Index Funds

When discussing total market index funds, it's important to understand the different types available. Generally speaking, there are two main categories – passively managed and actively managed.

Passively managed funds aim to track an index as closely as possible, typically through a strategy that utilizes low-cost investments. This fund offers investors instant diversification and is often the most cost-effective option.

On the other hand, actively managed funds employ a professional manager who trades within the fund to maximize returns. While actively managed funds may have higher costs associated with them, they can offer investors more customization and the potential for higher returns depending on the success of the fund’s manager.

Benefits of Investing in a Total Market Index Fund

Investing in a Total Market Index Fund can provide many benefits to investors. Here are some of the top advantages:

Low Cost: Most total market index funds have low expense ratios, which means that more of your money goes directly into investments rather than being taken out as fees and other expenses.

Diversification: Index funds provide investors with broad exposure to many different types of companies, allowing them to spread their investment risk across the entire market.

Tax Efficiency: Total Market Index Funds are often managed to minimize tax implications for investors.

Investment Returns: Over time, total market index funds tend to outperform actively managed funds, providing investors with potential long-term returns.

Liquidity: Total market index funds are highly liquid and can be bought or sold quickly and easily, making them a great option for short-term investments.

Transparency: The holdings of total market index funds are publicly available and can be tracked for performance.

Reduced Investment Time: Investing in a total market index fund saves the time required to research and pick individual stocks, allowing you to focus on other aspects of your investment strategy.

Accessibility: Total market index funds are widely available from many different providers, making them easily accessible for investors of all levels.

Understanding the Risks Associated with Investing in Total Market Index Funds

When investing in total market index funds, it's important to understand their associated risks. As with any investment, there is always the potential for loss. There are a few specific risks that come with investing in total market index funds:

Market risk – As with all investments, there is always the potential for markets to fall and cause losses. Even though you have broad exposure to most of the stock market, this still doesn't guarantee success; it's possible that all markets could suffer in the same breath.

Diversification risk – Even though total market index funds provide diversification, there is still potential for losses. You are still exposed to different stock market sectors and may be overexposed to certain industries or companies that could cause significant losses.

Tracking error risk – Tracking errors occur when the fund doesn't perform as expected. This could be due to the management style or the specific index used, and it can lead to losses if not managed correctly.

Tips for Selecting the Right Total Market Index Fund for You

Selecting the right total market index fund for your portfolio is an important decision that can significantly impact your long-term returns. Here are some tips to help you make the best choice:

Understand Your Investment Objectives – Establishing your investment objectives is important before selecting a total market index fund. Do you need growth? Income? Are there particular asset classes or sectors that are important to your strategy? Clarifying your goals will help you determine the best total market index fund for your needs.

Consider Your Time Horizon – Total Market Index Funds are typically long-term investments, so evaluating your time horizon is important as determining how long you plan to stay invested. This will help you decide which funds have the most potential for providing returns over your chosen timeframe.

Evaluate Expense Ratios – Look for total market index funds that offer competitive expense ratios, as fees can eat into your returns significantly over time. Remember that low-cost funds are typically more tax-efficient, meaning you’ll pay less in taxes over the life of your investment.

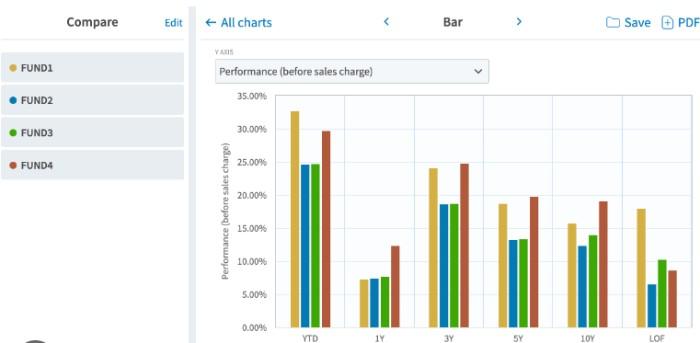

Assess Returns – Past performance does not always indicate future returns, but evaluating historical data can still provide valuable insights into a fund’s potential for growth or income. Check out fund ratings from sources like Morningstar for more information.

Diversify Your Holdings – Don’t put all your eggs in one basket! Investing in multiple total market index funds can help you spread out your risk and achieve greater diversification.

FAQs

How do I choose my portfolio's best total market index fund?

When choosing a total market index fund, you should consider factors such as fees associated with the fund, the minimum amount needed, and the potential return on investment. Additionally, it's important to evaluate the fund's risk profile. You should also compare different funds' historical performance.

What are the fees associated with investing in a total market index fund?

The fees associated with investing in a total market index fund vary from fund to fund. Generally, some funds may have higher expense ratios than others, which means you will pay more for the same returns. Additionally, there can be additional costs, such as trading commissions and other administrative fees.

Where can I purchase total market index funds?

You can purchase total market index funds from online brokerage and mutual fund companies. Be sure to compare fees and potential returns before investing in any fund.

Conclusion

Investing in a Total Market Index Fund can be a smart choice for many investors. You can ensure higher returns and greater potential gains with a diversified portfolio, minimal fees, and low costs associated with index funds. It's important to remember to select the Total Market Index Fund that best suits your risk tolerance and goals for the future.